Automated Forex Trading Software Revolutionizing Currency Trading 1931211860

Automated Forex Trading Software: Revolutionizing Currency Trading

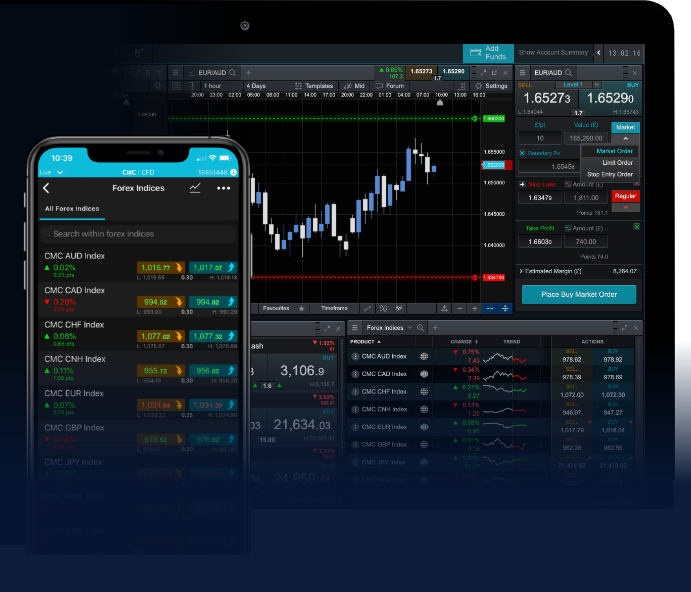

In the fast-paced world of forex trading, the introduction of automated forex trading software Trader Marocco has revolutionized how traders approach the market. Automated forex trading software, often referred to as trading bots or expert advisors, has become an essential tool for both novice and experienced traders. With the ability to analyze market conditions, execute trades, and manage risk without human intervention, automated trading systems offer a plethora of advantages that are reshaping the currency trading landscape.

Automated forex trading software has gained immense popularity due to its numerous benefits. First and foremost, these systems operate on algorithms that can process vast amounts of market data at lightning speed. Unlike human traders, who may be influenced by emotions or fatigue, automated systems execute trades based solely on predefined criteria. This dopamine-free decision-making process can often lead to more profitable trades, as the software eliminates emotional biases that can cloud judgment.

One of the foundational elements of automated trading software is technical analysis. Many programs utilize complex mathematical models to analyze historical price data, identify patterns, and predict future market movements. This analytical capability allows traders to make informed decisions even in volatile market conditions. Traders can set specific parameters such as entry and exit points, stop-loss limits, and risk levels, enabling the software to react instantly to market fluctuations.

An integral feature of automated forex trading software is backtesting. This process allows traders to test their strategies against historical data before deploying them in live markets. By analyzing how a strategy would have performed in the past, traders can refine their approaches, minimize risk, and increase their chances of success. Backtesting provides invaluable insights and helps traders understand the strengths and weaknesses of their strategies, ultimately leading to better decision-making.

Moreover, automated trading systems offer traders an unparalleled level of convenience. Since these programs can operate 24/7, traders can benefit from market opportunities even when they are not actively monitoring their accounts. This aspect is particularly advantageous for those engaged in part-time trading or those who have other commitments. The ability to set and forget a trading strategy also allows traders to capitalize on favorable market conditions while they focus on other pursuits.

However, it is important to recognize that automated trading is not without its challenges. One of the significant risks associated with automated trading software is over-optimization. Some traders may fall into the trap of fine-tuning their strategies to perform exceptionally well on historical data, resulting in a model that does not perform as well in live conditions. This phenomenon, known as curve fitting, can lead to substantial losses if traders are not cautious and critical of their strategies.

Additionally, traders must remain vigilant about the potential for technical glitches. Automated systems rely heavily on technology, and issues such as internet connectivity problems, platform malfunctions, or software errors can lead to missed opportunities or unexpected losses. It is crucial for traders using automated software to regularly monitor their accounts and ensure that everything is functioning as intended.

Despite these challenges, the advantages of automated forex trading software often outweigh the drawbacks. The ability to implement sophisticated strategies without the need for constant supervision has democratized access to forex trading. Retail traders, who may have previously felt overwhelmed by the complexities of the market, can now leverage these powerful tools to establish and manage their trading activities more effectively.

As technology continues to evolve, so does the landscape of automated trading. Machine learning and artificial intelligence are beginning to play a more prominent role in forex trading software, enabling programs to adapt to new data and changing market conditions. These advancements will likely lead to even more sophisticated and capable trading systems that can further enhance traders’ profitability.

In conclusion, automated forex trading software is reshaping the currency trading environment by providing traders with powerful tools to analyze markets, execute trades, and manage risk with greater precision. While there are challenges to consider, the benefits of speed, efficiency, and the ability to operate without emotional bias make automated systems invaluable in today’s trading landscape. As technology advances, traders who embrace these innovations will likely find themselves at a significant advantage in the ever-evolving forex market.