Beginner Forex Trading A Comprehensive Guide 1559091422

Beginner Forex Trading: A Comprehensive Guide

Forex trading, or foreign exchange trading, is the process of buying and selling currencies in the foreign exchange market with the aim of making a profit. The forex market is the largest financial market in the world, with a daily turnover of over $6 trillion. For beginners, entering this vast and complex market may seem daunting, but with the right knowledge and tools, anyone can learn to trade profitably. In this article, we will cover the basics of forex trading, essential strategies, tips for getting started, and the importance of choosing the right broker, such as beginner forex trading Trading Brokers in Vietnam.

What is Forex Trading?

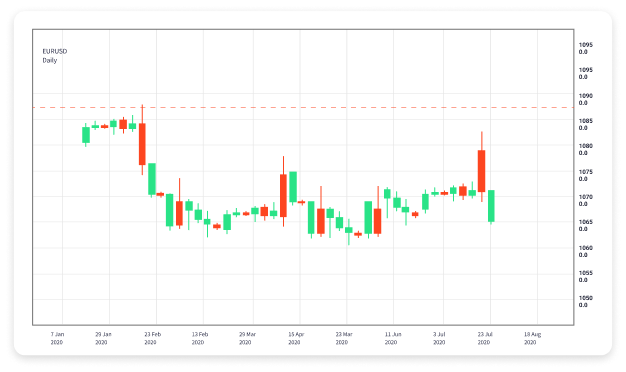

Forex trading involves the exchange of one currency for another. This is done in pairs; for example, EUR/USD represents the exchange rate between the euro and the US dollar. When you trade forex, you speculate on whether one currency will rise or fall against another. If you believe the euro will strengthen against the dollar, you would buy the EUR/USD pair. Conversely, if you think the euro will weaken, you would sell the pair.

Understanding Currency Pairs

Currency pairs are the foundation of forex trading. There are two types of currency pairs:

- Major pairs: These include the most traded currencies such as EUR/USD, USD/JPY, and GBP/USD.

- Minor pairs: These currency pairs do not include the US dollar but involve other popular currencies, such as EUR/GBP or AUD/NZD.

Each currency pair has a base currency (the first currency listed) and a quote currency (the second currency listed). The price of the pair tells you how much of the quote currency you need to buy one unit of the base currency.

Key Terminology in Forex Trading

To navigate the forex market effectively, beginners should familiarize themselves with essential terminology, including:

- Pip: The smallest price move that a given exchange rate can make based on market convention.

- Spread: The difference between the bid (selling) price and the ask (buying) price of a currency pair.

- Leverage: A tool that allows traders to control a larger position than they would with their own capital alone.

- Margin: The amount of money required to open a leveraged position.

Choosing a Forex Broker

Selecting the right forex broker is crucial to your trading success. Here are some key factors to consider:

- Regulation: Ensure the broker is regulated by a credible authority to ensure the safety of your funds.

- Trading platform: A user-friendly trading platform is essential for executing trades effectively.

- Fees and spreads: High fees can erode your profits, so compare the costs associated with trading on different platforms.

- Customer service: Look for brokers that provide excellent customer support, as this can help resolve any issues you encounter.

Developing a Trading Strategy

Having a well-defined trading strategy is essential for success in forex trading. Here are a few popular strategies that beginners might find helpful:

- Day trading: This involves making multiple trades within a single day, focusing on short-term price movements.

- Swing trading: This strategy aims to capture short to medium-term market movements, holding positions for several days or weeks.

- Scalping: This is a high-frequency trading strategy that takes advantage of small price gaps created by order flows or spreads.

Risk Management

Effective risk management is crucial for any trader. It ensures that you can sustain losses without depleting your trading capital. Some key risk management techniques include:

- Setting stop-loss orders: A stop-loss order automatically closes your position at a predetermined loss level, helping to minimize losses.

- Position sizing: Determine how much of your total capital to risk on individual trades to maintain a balanced portfolio.

- Diversification: Avoid putting all your capital into a single trade. Spread your investments across different currency pairs to mitigate risk.

Emotional Control in Trading

Trading can be an emotional rollercoaster. Many beginners let fear or greed dictate their trading decisions. Developing emotional control is vital. Here are some tips:

- Stick to your trading plan: Avoid impulsive decisions by adhering to your strategy and rules.

- Accept losses: Understand that losses are part of trading and should be anticipated.

- Maintain discipline: Even in the face of temptation, remain disciplined and follow your established trading routine.

Continuous Learning and Adaptation

The forex market is constantly evolving, and staying updated with market trends and economic news is crucial for success. Educate yourself continuously by:

- Reading books and articles: There are many resources available that can enhance your trading knowledge.

- Participating in webinars and courses: Online courses can provide in-depth insights and strategies from experienced traders.

- Practicing with demo accounts: Many brokers offer free demo accounts. Use these to practice trading without risk.

Conclusion: Starting Your Forex Trading Journey

Forex trading offers vast opportunities for beginners willing to learn and adapt. By understanding the fundamentals, developing a solid trading strategy, and implementing effective risk management techniques, you can confidently navigate the forex market. Remember to choose a reputable broker and continuously educate yourself to enhance your trading skills. With dedication and discipline, you can achieve your trading goals!