Best Platform for Forex Trading A Comprehensive Guide 1642238204

Finding the Best Platform for Forex Trading

Forex trading is gaining prominence globally, with countless traders seeking profitable opportunities. Choosing the right trading platform is pivotal to ensuring your trading experience is smooth and profitable. This article will help you navigate the vast options available, including insights on various platforms and best platform forex trading Cambodia Brokers.

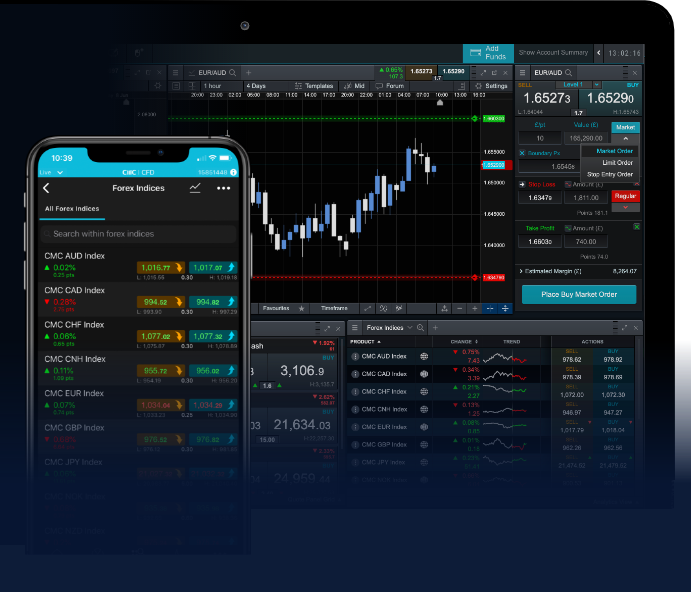

Understanding Forex Trading Platforms

A forex trading platform is software that enables traders to access the financial markets for buying and selling currencies. These platforms not only provide traders with the necessary tools for trading but also facilitate account management, monitoring of trades, and performance tracking. The best platform should be user-friendly, reliable, and equipped with advanced trading features.

Key Features of Top Trading Platforms

When evaluating different forex trading platforms, consider the following features:

- User Interface: A clean, intuitive interface can simplify trading and make it easier for both beginners and experienced traders.

- Security: Ensure the platform employs robust security measures, including encryption, two-factor authentication, and safe data handling practices.

- Tools and Resources: Look for platforms that offer a variety of analytical tools, educational resources, and market news.

- Customer Support: Quality customer service is crucial. The platform should provide various communication options, including live chat and phone support.

- Fees and Spreads: Understand the fee structure, including spreads, commissions, deposit and withdrawal fees, to ensure they align with your trading strategy.

Popular Forex Trading Platforms

Here’s a rundown of some of the most popular forex trading platforms available today:

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most widely used platforms among forex traders. It offers a comprehensive array of features, including advanced charting tools, automated trading through Expert Advisors (EAs), and multi-device compatibility. Its vast community and support make it an accessible option for traders at all levels.

2. MetaTrader 5 (MT5)

While MT4 remains popular, MetaTrader 5 is evolving as a strong competitor. It provides additional features, including more timeframes, technical indicators, and a built-in economic calendar, making it suitable for more intricate trading strategies.

3. cTrader

cTrader is renowned for its sophisticated and user-friendly interface. It focuses on transparency and offers an array of trading features, including advanced charting, algorithmic trading capabilities, and one-click trading functionality.

4. TradingView

Though primarily known as a charting platform, TradingView also allows for direct trading with several brokers. Its social trading features enable traders to share ideas and strategies, fostering a community of learning.

Choosing the Right Broker

Selecting the right broker is as crucial as choosing the right trading platform. Ensure your broker is regulated and offers a platform you are comfortable with. Here are a few tips to help you choose:

- Regulation: Choose a broker regulated by a reputable authority to ensure safety and trustworthiness.

- Trading Account Types: Look for brokers that offer various types of accounts to accommodate different trading styles and capital.

- Deposit and Withdrawal Options: Examine the available payment methods, ensuring they align with your preferences.

- Leverage Options: Depending on your trading style, leverage can impact your trade outcomes significantly. Ensure the broker offers appropriate leverage levels.

Incorporating Risk Management Strategies

Even with the best trading platform and broker, the risks of forex trading remain. It’s essential to implement effective risk management strategies to protect your investments. Consider the following methods:

- Use of Stop-Loss Orders: This tool helps limit potential losses by automatically closing a trade once it reaches a predetermined level.

- Position Sizing: Determine how much of your account you are willing to risk on each trade to manage exposure effectively.

- Diversity: Avoid putting all your capital into one trade. Diversifying your portfolio can mitigate risks and improve your overall trading performance.

Conclusion

Choosing the best platform for forex trading involves a careful evaluation of various factors, such as features, fees, user experience, and broker reliability. The right choice can enhance your trading experience significantly, providing you with better opportunities to thrive in the competitive forex market. Make informed decisions, leverage available resources, and always approach trading with a solid plan and risk management strategies. As you engage with the forex market, staying educated and aware of the dynamic nature of trading will serve you well on your journey toward financial success.