Breaking News in Forex Trading What Traders Need to Know

The world of Forex trading is influenced by numerous factors, ranging from geopolitical events to economic data releases. Staying updated with the latest forex trading news Forex Brokers in Saudi Arabia and global trends is essential for achieving success in this dynamic market. This article delves into the most recent developments in Forex trading news, providing insights that can help traders navigate the complexities of the foreign exchange market.

Understanding Market Influencers

The Forex market is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. Given its size, numerous variables can affect currency prices, including economic indicators, interest rates, and political stability. Therefore, it is imperative for Forex traders to keep an eye on market influencers to make better trading decisions.

Recent Economic Developments

This year has seen various economic reports that have caused significant volatility in the Forex market. Key reports, such as Gross Domestic Product (GDP), unemployment rates, and inflation figures, provide insights into the economic health of a country. For instance, the recent uptick in inflation rates in major economies like the US and the Eurozone has led to speculations regarding interest rate hikes, which typically strengthen the respective currencies.

The US Economic Landscape

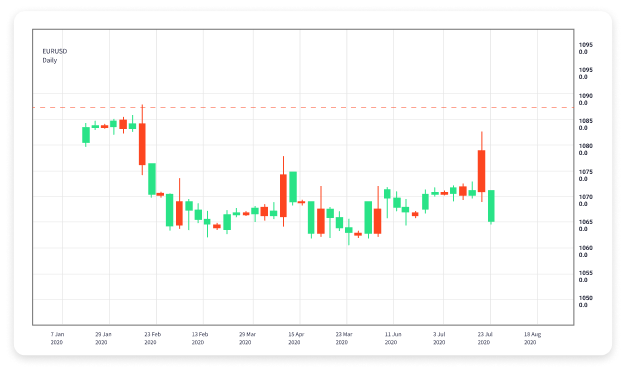

In the United States, the Federal Reserve continues to play a pivotal role in shaping Forex trading dynamics. The central bank’s policies, particularly its stance on interest rates, have a direct impact on the US dollar’s strength. Recent statements from the Fed regarding potential rate hikes have caused fluctuations in USD pairings, as traders assess the implications on various currency pairs like EUR/USD and GBP/USD.

The Eurozone’s Stability

Similarly, the Eurozone is witnessing its own economic challenges. The European Central Bank (ECB) has been dealing with inflationary pressures while trying to support economic growth. The balance between these two can be difficult to achieve, leading to uncertainty around the Euro. Traders need to monitor ECB announcements closely, as changes in monetary policy can lead to immediate impacts on currency values.

Geopolitical Events and Their Impact

Geopolitical instability is another crucial factor influencing Forex markets. Events such as elections, trade disputes, and international conflicts can lead to sudden shifts in market sentiment. For instance, the ongoing tensions in Eastern Europe have caused fluctuations in currencies of countries directly and indirectly involved in these conflicts. Moreover, the rise of populism in various countries has introduced additional uncertainties for traders to consider.

Trade Agreements and Tariffs

Trade agreements can also have a profound effect on the value of currencies. Recent negotiations and tariffs imposed on certain countries can lead to depreciation or appreciation of currencies, as traders reassess the economic prospects of the nations involved. For instance, any announcements regarding trade relations between significant economies like the US, China, and the EU can lead to swift reactions in Forex markets.

Forex Trading Strategies in Light of Current Events

Given the ever-changing landscape of Forex trading, adapting trading strategies is essential for success. Here are some effective strategies that traders can implement to navigate the current market conditions:

1. Fundamental Analysis

Understanding economic indicators and geopolitical events is crucial. Traders should consistently analyze news releases and reports to inform their trading decisions. Keeping an economic calendar and subscribing to Forex news feeds are helpful methods to stay updated.

2. Technical Analysis

Technical analysis remains a cornerstone of Forex trading. By studying price movements, chart patterns, and indicators, traders can identify entry and exit points. Combining both fundamental and technical analysis can provide a comprehensive view of the markets.

3. Risk Management

Implementing a robust risk management strategy is imperative, especially in volatile markets. Traders should set stop-loss orders to safeguard against significant losses and ensure that their trading sizes align with their risk tolerance.

Staying Ahead with Forex Trading News

In conclusion, staying informed about the latest news and developments in Forex trading is vital for traders looking to succeed. By understanding the economic indicators and geopolitical factors that influence currency prices, traders can make more calculated decisions. Furthermore, integrating effective strategies and maintaining a proactive approach will empower traders to adapt to the ever-evolving Forex landscape.

As the Forex market continues to evolve, traders must remain vigilant and informed. Whether you are a seasoned trader or just starting out, leveraging the right tools and resources can enhance your trading experience and ultimately lead to better outcomes.